Welcome to the Money Hacks Carnival #10! This is my first "guest hosting" of the Carnival and I'm excited to get things rolling. There were many submissions, lots of good reading, and all of them included below were very informative and entertaining. I'm calling this the "Your Money, Your Life" edition because money and life are inextricably intertwined.

Welcome to the Money Hacks Carnival #10! This is my first "guest hosting" of the Carnival and I'm excited to get things rolling. There were many submissions, lots of good reading, and all of them included below were very informative and entertaining. I'm calling this the "Your Money, Your Life" edition because money and life are inextricably intertwined.

Grab a good beverage, find a spot to read, and have an open mind. Now, let's get started!

Best Money Hacks (Editor's Picks)

The best of the best.

The Eclectic Female submitted How To Talk About Money With Your Partner posted at Women's Lifestyle Blog.

Instead of phrasing the conversation in terms of negatives – like his low credit score or her shopaholic tendencies – focus on your future goals. If you want to buy a home, a car or a business, talk about the positive action steps you need to take to make your dream a reality.This is by far one of the most important conversations you'll ever have. Better to find out sooner rather than later. This is not to suggest that money trumps love; rather, you don't want the resentment caused by money problems to wreck an otherwise rally healthy and mutually beneficial relationship.

AJC presents How your hobby can set you financially free! « How to Make 7 Million in 7 Years™ posted at How to Make 7 Million in 7 Years™.

Do what you love and you'll never need a job. If you can begin dabbling in making earning some money from something you truly love and save as much as possible from that endeavor, you're way ahead of the game. Additionally, in the current economic climate, lots of us with "day jobs" are at risk of getting laid off. If you've begun building a client list, referrals, and a body of work, you've not only diversified your income, but you've laid the foundation for a new beginning.

Leaving The Folks brought us Creating a Budget posted at Real World Advice.

Another blog post about budgets! Ay! However, this post presents the concept in a really easy-to-implement way. Sometimes, we have to get back to the fundamentals, and creating a budget is one of the most elementary fundamentals.

Todd presents Financial Kung Fu posted at HarvestingDollars.

This is such an entertaining post, comparing the famous martial art with personal finance.

Writer's Coin wrote The Writer’s Coin » Blog Archive » Someone Else’s Money posted at The Writer's Coin.

Such a touching story. It reminds us that in the Your Money, Your Life, Life really comes first.

Earn It

Here are some ways to earn "extra" money (note that there is never any "extra" money -- it all goes somewhere -- hopefully in savings or investments!)

Fitz Villafuerte gave us Top 8 Things You Can Sell Your Officemates For Extra Income posted at Ready To Be Rich.

Interesting ideas.

Bryce presents Treasure in the Garage posted at Save and Conquer.

There's always some hidden treasure in the garage.

Madison submitted Diversification of Income posted at My Dollar Plan.

Having more than one source of income is a fantastic idea.

Shanti presents Starting a Snowflake Business: (Part 2) The Materials posted at Antishay Ventenne.

Spend It

Let's face it: No matter how frugal you are, you will spend money. Here are some novel ways to minimize your spending.

Green Panda blogged about Cutting the Cable Bill posted at Green Panda Treehouse.

Do we need 500 cable channels?

Mike Leonard brought up an interesting perspective in Up to your eyeballs in debt – so what? posted at Until Debt Do Us Part.

A different perspective on debt. Read the whole article and I think you'll come away with a different takeaway than the title suggests.

Kaye presents Leaning from My Friends' New Purchase posted at Mrs Nespy's World.

Many people own cars that are out of their league. This is one of those stories.

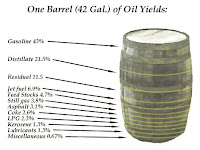

Wenchypoo wrote about Inflation + Shortages = Stealth Tax Increase posted at Wisdom From Wenchypoo's Mental Wastebasket.

S.B. shared some money-saving ideas in the post, Free Products at Drugstores - Rite Aid, Walgreens & CVS Explaination posted at Be Thrifty Like Us.

Amy @ The Q Family presents Be a Hero. "Save the Cash, Save the World" posted at The Q Family Adventure.

Silicon Valley Blogger showed us that Cheaper Toys ARE Better For Your Kids! posted at The Digerati Life.

Love the DIY robot costume!

Pinyo presents 34 Ways To Save Money On Car Expenses posted at Moolanomy.

Great list!

ChristianPF presented How to make a budget posted at Christian Personal Finance.

VERY comprehensive post about budgeting. The best pro athletes always practice the fundamentals.

Foxie gave us No Temptation, Just Motivation posted at Dreaming of Ferraris.

If you can't pay cash for it, don't buy it...great advice.

paidtwice presents With the Price of Everything Going Up, How Do You Budget? | I've Paid For This Twice Already... posted at I've Paid For This Twice Already....

Faron Benoit told us about Budgeting 101 posted at Financial Learn.

Lisa Spinelli presents Running the Gauntlet on Debt: A Debt Reduction Plan posted at Greener Pastures.

The most important concept in personal finance: Planning. If you don't plan for a positive outcome, you probably won't get it.

Chrysa showed how to Get a 10% Bonus on Your Economic Stimulus Check by Buying Groceries! posted at Thrifty Jinxy.

Not sure about the validity of this story, but if it's true, it's worth some investigation.

RC presents How to Simplify Your Finances-Start Small with Automatic Bill Payments posted at Think Your Way to Wealth.

FIRE Finance shared the Top 5 Freebie Websites! posted at FIRE Finance.

Save It

One of the keys to financial success is saving a good chunk of your income. Here, we find ways to save: Some old, some new.

Dorian Wales gave us the How to Make Saving More Rewarding and Tangible: 5 Practical Tips posted at Personal Financier.

Ray presents ING Direct Referral Links For New Accounts posted at Money Blue Book: Personal Finance Blog.

Ryan Taylor showed us how to build an emergency fund in 8 Ways to Build an Emergency Fund posted at Millionaire Money Habits.

Building an emergency fund is often difficult, but Ryan walks us through some relatively painless ways.

Will gave us a step-by-step guide to Switching Banks? Step By Step Guide and Tips posted at Your Finish Rich Plan.

I never really thought about switching banks in this way, but it does seem a bit complex, or at least very tedius.

GBlogger asked With Rates Dropping, What Are We Doing With Our High-Yield Savings Accounts—E*TRADE, ING Direct, and One United? posted at CAN I GET RICH ON A SALARY.

As the Fed targets a lower Fed funds interest rate, all other short-term rates will be reduced.

Ken Clark, CFP shed some light on college savings plans in Section 529 Review: Alaska T. Rowe Price College Savings Plan posted at Saving for College - About.com.

Not enough is written about college savings/investment plans. 529s are great investment vehicles.

The Dough Roller shared 11 Online Retirement Calculators posted at The Dough Roller | Smarter Money Management.

Great resource. Gotta love the plethora of online financial planning tools.

Preserve It

Insulating yourself from catastrophic loss is one of the more mundane, yet totally necessary, personal financial tasks. Here are some posts that touch on the subject.

Jonathan said in Divorce and Credit Card Debt don't mix! | Master Your Card posted at Master Your Card,

All joint credit cards will continue to be a joint responsibility until either the debt is paid off or until the lender agrees otherwise.Very important consideration.

MoneyKing presents Sex With Your Ex???? It Might Cost You. posted at The Money Kings - RULE your money at home, at work, and at play!.

Mike asks Leaving town? Don’t waste money on car insurance posted at Living the Cheap Life.

Invest It

Investing your hard-earned money is fun. But you have to do all the other things to build a solid foundation for investing success.

Sally Thompson submitted Recession Proof Your Portfolio: 50 Best Blogs for Free Investment Advice posted at Currency Trading.net.

Big list of web sites with investing advice.

Barb A. Ryan presents Asset Allocation, Investment Asset Tax Location, and Emergency Cash Management posted at Pasadena Financial Planner.

Enoch Ko gave us a primer on Analyzing your financial statements at The Wealth Accumulator.

Don presents Pre Construction Investing posted at Tony Travis.

In today's environment, this is more risky, but if you have some expertise and a stomach for it, it's worth investigating.

Brice Hogan showed us how to set up a 6 Minute Retirement Plan posted at Financialzip.com.

Simplified retirement planning.

Michael Cohen presents his reasoning on Why I Sold My Apple Shares Today » Free Stock Market Investing Tips posted at Stock Tips.

TheWild1 asked What are you expecting from Microsoft? posted at The Wild Investor.

The Shark Investor gave us a little personality quiz in Discover Your Investment Style In 15 Minutes posted at The Shark Investor.

Joe Manausa wrote The Real Estate Market - When Will We See The Turn? posted at Tallahassee Real Estate Blog.

Bull Returns presents Stock Investment Resource: Stock Market Investing Tips - Is Small Cap Value The Key For 2008? posted at Stock Investment Information.

KCLau shed some light on a foreign stock exchange in Everything you are looking for about Bursa Malaysia posted at KCLau's Money Tips.

Eric presents Growing Money posted at Make Money Blog.

Another iteration of the magic of compound investing.

Jed Norwood presented What Forex Broker Should You Use? posted at Forex Strategy.

Miscellaneous

These posts could be placed in multiple categories, or they don't fit at all. Nevertheless, all offer sound ideas and advice.

FMF asked Do You Use Money to Discourage Bad Behavior? posted at Free Money Finance.

Warren Wong showed us Why Being Generous Makes You Wealthy posted at Personal Development.

Win-win.

Aryn gave us a great tip in When Are You Entitled to a Free Copy of Your Credit Report? posted at Sound Money Matters.

Heather Johnson presents 3 Lesser Known Factors Affecting the Forex Markets. posted at You Are The Worst dot Com.

Steve Faber presents Debt Relief – Do Settlement, Counseling, or Debt Relief Programs Really Work? posted at Debt Free.

Heather Allen shared her experiment in The Big £5 Project posted at The DebtFree Playbook Blog.

Joe D took a different approach in Credit Card Debt Can Be Good | Know The Ledge posted at Know The Ledge.

PT showed us how to Stop Junk Mail: My Earth Day Effort over at Prime Time Money.

Save trees, save money, save time.

FFB told us the tale of one scam, where a malicious web site was created to phish for personal information in Beware IRS Tax Refund Scams posted at Free From Broke.

And Now For a Little Humor

Madeleine Begun Kane presents Dear IRS posted at Mad Kane's Humor Blog.

Me too!

Conclusion

We've covered a lot of ground in this carnival. We shared a wide range of blog posts about everything from earning, spending, saving, preserving, and investing.

Thanks to all for your participation. Until next week...